Without checks and balances, scrutinizing and challenging foundation leaders’ million-dollar paychecks is nearly impossible.

The below column originally appeared in The Chronicle of Philanthropy on March 27, 2024.

***

The disclosure that Rajiv Shah, president of the Rockefeller Foundation, received $1.6 million in compensation in 2021—the highest of any big foundation CEO in the United States—stirred significant debate after it was first reported by the Chronicle of Philanthropy. But how do we know if foundation executives are being paid fairly?

Setting executive compensation is complicated in any field, but a combination of internal performance measures and external scrutiny usually provides some assurance that salaries aren’t extravagant or unjustified. For foundation executives, neither hard performance metrics nor external watchdogs are available to measure performance or blow the whistle on exorbitant pay. As a result, most foundation boards settle on a comfortable amount that corresponds to the CEO compensation at similar institutions.

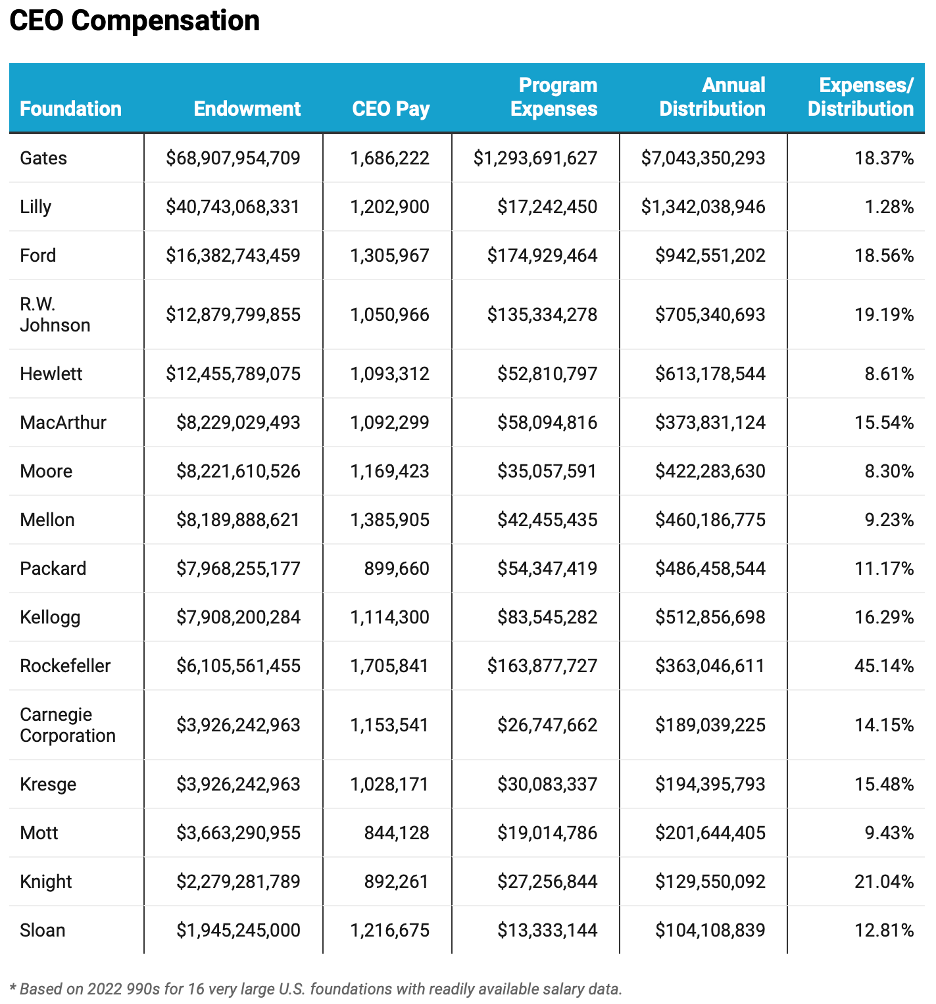

A sampling of 16 very large U.S. foundations with readily available salary data shows the two highest paid foundation CEOs are Shah, whose salary actually rose to more than $1.7 million in 2022, according to Rockefeller’s most recent 990, and Mark Suzman, CEO of the Gates Foundation, whose salary was $1.6 million. But those exceptions aside, the top executives all received compensation in the high six and low seven figures. (See chart)

New York-based executives were paid more than those in Michigan, Indiana, or even California. Size of the endowment was a factor but not determinative. Indeed, at nine of the 16 foundations, the president’s salaries were within $100,000 of the $1.1 million average. That suggests great attention to how much others are paid.

These are hefty paychecks by any measure, but they’re particularly notable for foundations, since much of a president’s salary counts toward the organization’s 5 percent distribution requirement. That’s one reason why Shah’s compensation raised eyebrows. Rockefeller has unusually high expenses, including program and salary costs, accounting for 45 percent of its charitable activity in 2022, compared with 18.5 percent at Ford and 8.9 percent at Hewlett.

Corporate lessons

What’s the best way then to determine if a foundation president’s salary is truly out of line? The corporate world might offer some answers.

Most boards of publicly traded companies have compensation committees that create performance benchmarks for their leaders—typically tied to long-term growth and profitability. If the company doesn’t reach these targets, executive compensation is reduced and, if the results are particularly bad, the CEO and other senior executives may be fired.

Additionally, CEO compensation is a perennial topic for business journalists and op-ed commentators. Bloomberg recently ran a piece with the headline: “Elon Musk is Overpaid.”

Similarly, rating agencies, such as Institutional Shareholder Services, scrutinize executive compensation and may advocate for shareholder votes on how much CEOs should be paid. The Securities and Exchange Commission also monitors executive compensation and can act if they believe a CEO’s pay is too high.

Individual shareholders can voice their concerns as well by bringing lawsuits against a company for overcompensating its CEO, as they did with Musk. The judge in that case rejected Musk’s $56 billion Tesla salary, calling it an “unfathomable sum.” With these checks and balances, a public company may overcompensate its president in the short term but will find it hard to sustain in the long run.

Little accountability

The nonprofit world is more challenging. Some charitable institutions, such as the large health-care chains, can easily adopt corporate standards for compensation. The CEOs of these organizations often have multimillion dollar salaries and their pay, like corporate executives, is set largely by factors such as the financial health of the institution and whether customers are happy with the care they receive. Indeed, the similarities are so great that some experts question whether these large and wealthy businesses should even have nonprofit status.

For most other nonprofits, fundraising ability is certainly one tangible criterion that can be applied to compensation. If executives can’t increase, or at least maintain, the organization’s budget, they are unlikely to last long, let alone receive a raise.

In addition, nonprofit boards increasingly set key performance indicators for CEOs. These can be as concrete as increasing the number of people served at a homeless shelter or improving attendance at a museum. External evaluators, such as Charity Navigator and GiveWell, as well as issue-specific groups, can also report on an organization’s financial health and effectiveness.

The media is a further check on excessive nonprofit compensation, as the CEOs of nonprofit hospitals have discovered. In his day, the late Pablo Eisenberg, a trenchant philanthropy watchdog and Chronicle of Philanthropy contributor, was perhaps the sharpest critic of excessive compensation in the nonprofit world. And back in the early 1990s, media coverage of United Way exposed the lavish lifestyle of its CEO.

It’s worth noting that at many of the largest foundations, the highest paid employee often isn’t the president, but the chief investment officer, or CIO. At Ford, for example, president Darren Walker’s total compensation was $1,305,967 in 2022, according to its 990, while Eric Doppstadt, the CIO, made $4,564,648. At Hewlett, former president Larry Kramer made $1,093,312 and CIO Ana Marshall received $5,567,394. And at the Andrew Mellon Foundation, both the top investment officer, Scott Taylor, and the chief legal officer, Sheree Carter-Galvan, made several million dollars more than the institution’s leader, Elizabeth Alexander.

This disparity makes sense in most cases. Success or failure for investment professionals is obvious when performance is measured against quantifiable goals and the performance of peer institutions. Perhaps more importantly, the market for talented investment gurus is highly competitive.

If investment performance sets the CIOs salary, what factors should foundation boards use to set the president’s compensation?

Increased oversight

Certainly, the Rockefeller board would argue that its high executive compensation and program expenses are justified. But if Rockefeller was a corporation or a typical nonprofit, regulators, investors, the media, and donors would insist on concrete justification for why the president’s compensation is higher than that of other foundation leaders.

Without this oversight, measuring a foundation CEO’s impact is difficult. Federal and state regulators haven’t delved into foundation compensation issues for many years. Few stakeholders, including current and potential grantees, are willing to risk losing funding by criticizing compensation or other management practices at major foundations. And aside from the Chronicle of Philanthropy, media coverage of foundation salaries in the last year was almost non-existent.

If there are egregious abuses in executive pay, some state attorneys general will take action. That’s what happened in the case of the Otto Bremer Trust, where one of its top executives was found to have engaged in self-dealing and to have received excessive compensation. However, it takes a lot to reach the attention of federal or state officials.

Another option is to ask foundations to specify each year on their 990s how compensation decisions are made. As part of their 990s, nonprofits are required to submit a Schedule J that details the methods and resources used to determine executive compensation. Foundations should have to do the same.

More aggressive journalism focused on covering the excesses of private foundations would also help. Ken Vogel of the New York Times has made a name for himself by investigating the behavior of nonprofits with close ties to liberal and conservative interests. Given the powerful influence of Ford, Bloomberg, Gates, Rockefeller, and other foundations on public policy and attitudes, these institutions deserve just as much scrutiny.

Press Forward, the consortium of foundations supporting the rebirth of serious local news coverage, could steer some of its funds towards investigative reporting on their own elite slice of the nonprofit world. I won’t hold my breath though. Foundations love to fund groups that hold government and corporations accountable. They are less interested in shining a similar spotlight on their own work.

But perhaps a few brave donors, recognizing that the reputation of the philanthropic world is at stake, will offer support for those rigorous critics willing to speak up when foundations pay their CEOs too much or otherwise act irresponsibly. An army of Pablo Eisenbergs should do the trick.