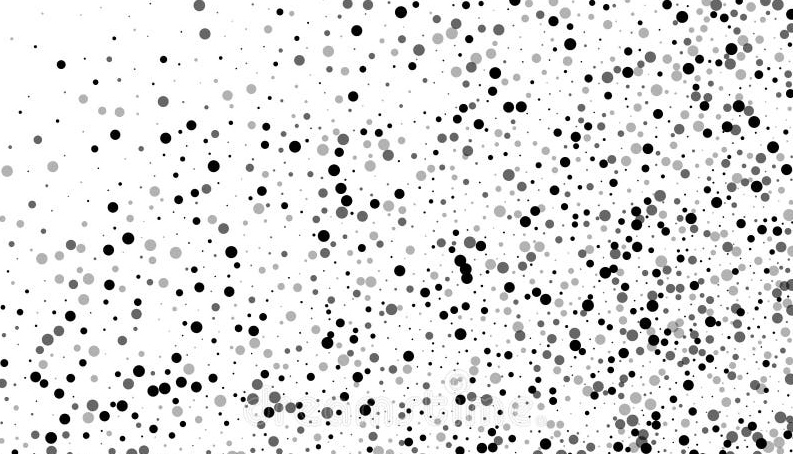

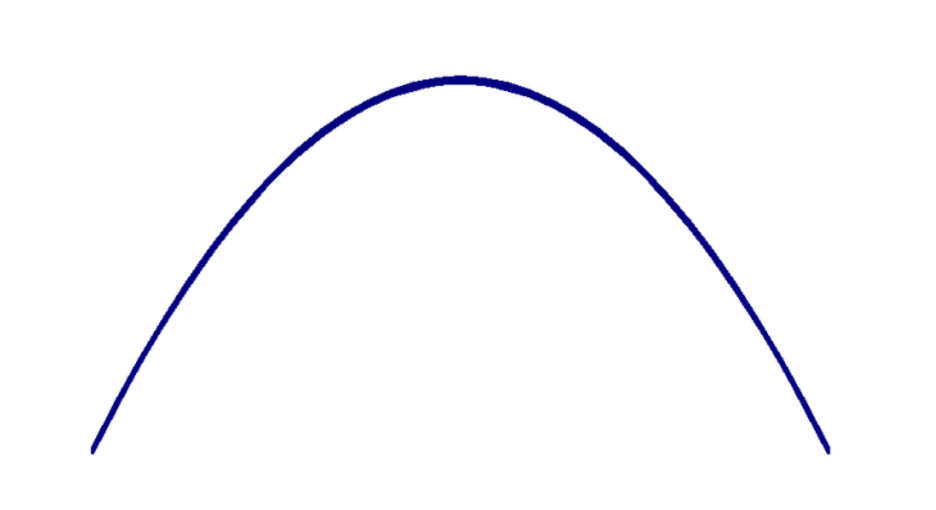

Why do so many social-science studies show “mixed” results?

Good character and healthy habits are best transmitted through trusting human relationships. The strength of those relationships is difficult to quantify, but research that ignores them can only produce inconclusive evidence.