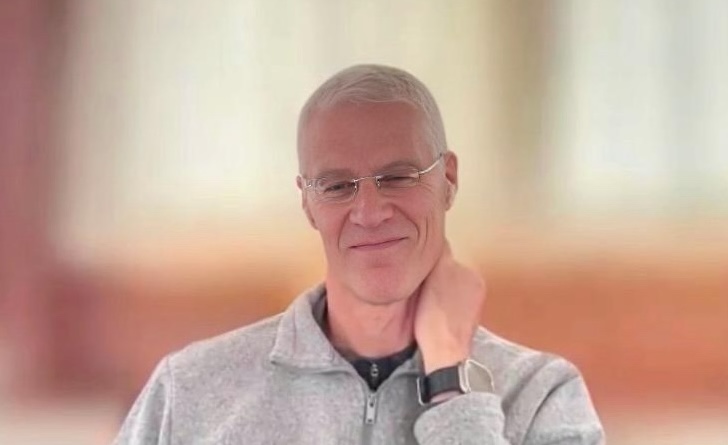

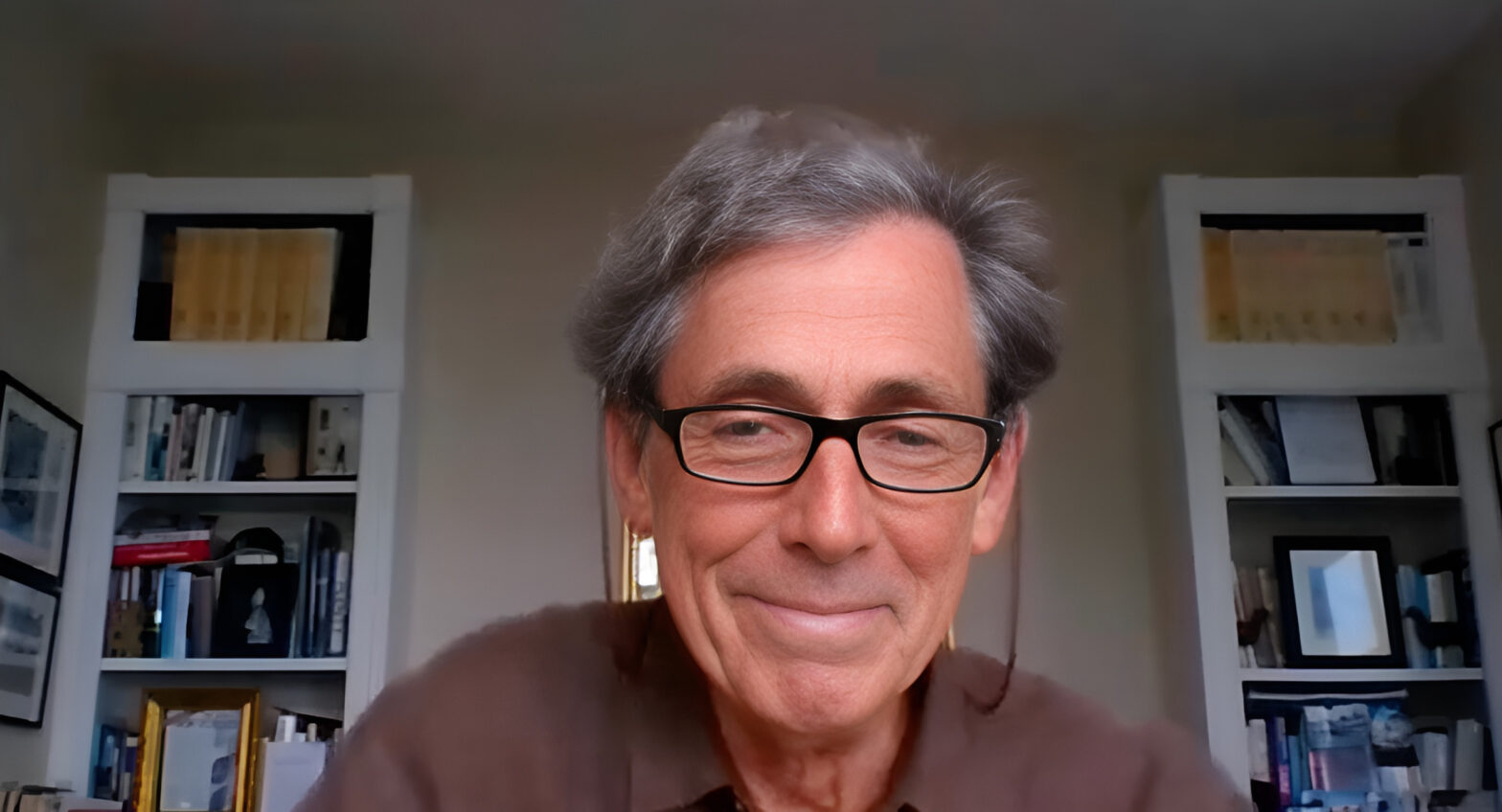

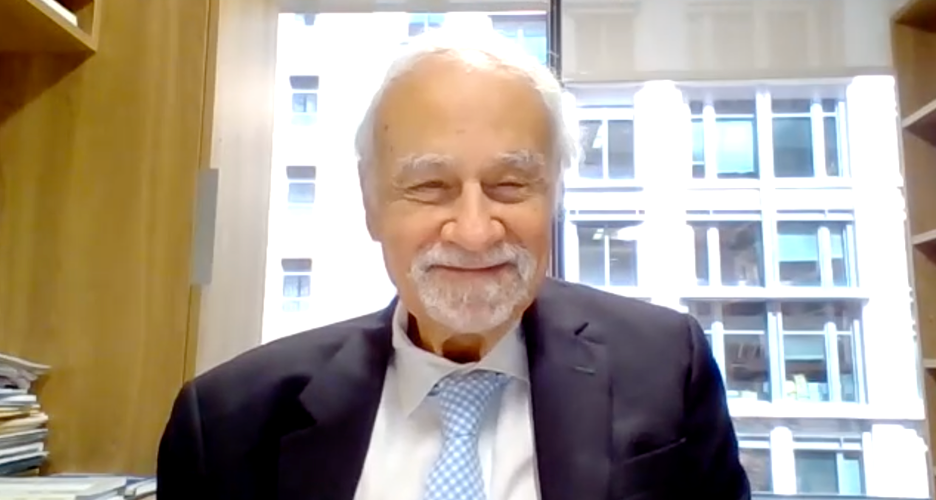

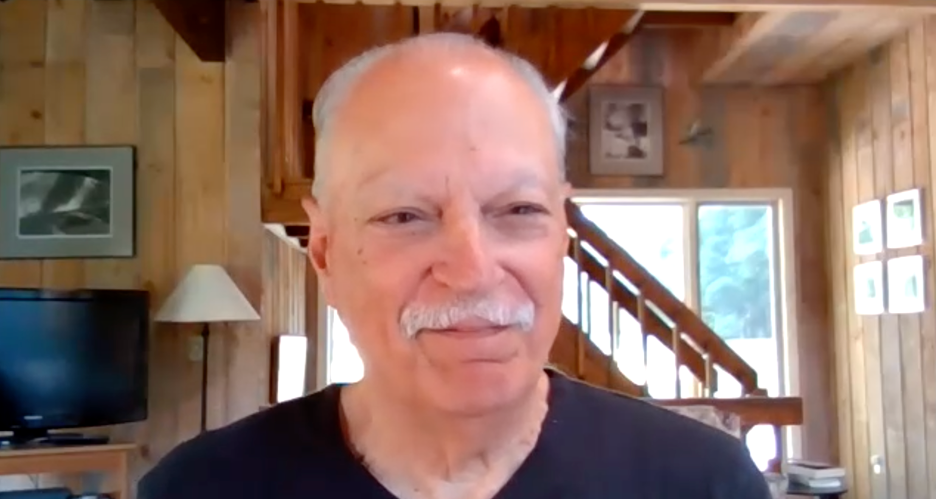

A conversation with nonprofit consultant Alan Cantor (Part 2 of 2)

On the basis of his long experience in the sector, the advisor, observer, and commentator talks to Michael E. Hartmann about those against DAF reform, some of the different kinds of nonprofit board members, different types of grantmaking strategies and tactics, and the underappreciated value of staffs at nonprofits.